One Wrong Step: Why Skipping Appropriate Policies and Procedures Can Sink Your Small Business

Australian small businesses move fast, yet too many forget that appropriate policies and procedures are their first line of defence. From six-figure Fair Work penalties to privacy fines that reach the tens of millions, ignoring documentation can drain cash flow, erode culture, and damage hard-won reputations in hours.

Decode Before You Commit: Navigating Grant Jargon, What to Look for Before You Apply

Grants can fuel growth, but only if you understand what you’re signing up for. Learn how navigating grant jargon before you apply can save time, money, and missed opportunities.

The Vanity Trap: What Small Businesses Get Wrong About Social Media Metrics

Impressions aren’t impact. Likes aren’t loyalty. Discover what small businesses get wrong about social media metrics, and how to track what actually drives growth and revenue.

Stop the Scramble: BAS, Payroll and EOFY – How to Plan, Not Panic

Deadlines shouldn’t feel like danger zones. Learn how Australian SMEs can prepare for BAS, payroll and EOFY with calm, clarity, and confidence, before the pressure hits.

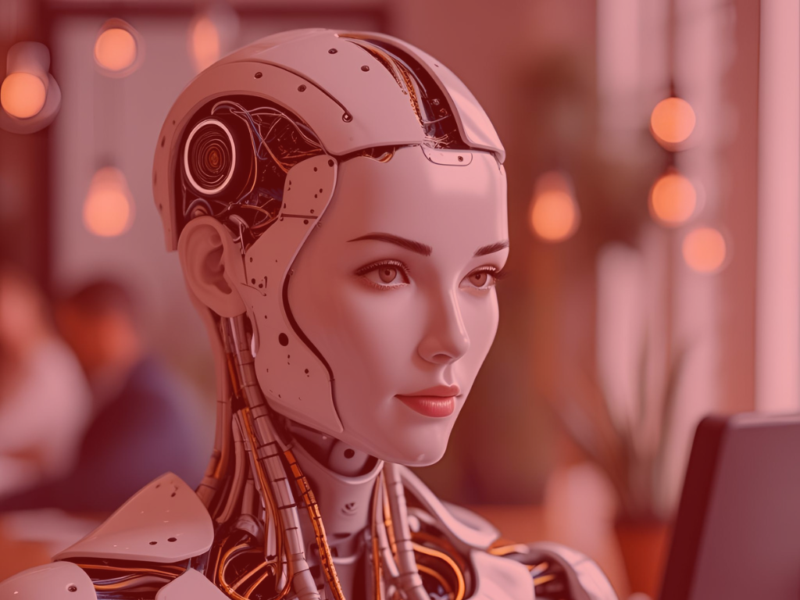

AI Isn’t Just for Tech Giants: How Australian Small Businesses Can Harness It Today

Artificial intelligence is no longer out of reach for small businesses. Discover how your business can benefit from practical, affordable, and effective AI tools today.

Dead Ends or Gold Mines? How to Identify Which Tenders or Grants Are Actually Worth Your Time

With thousands of tenders and grants available, most businesses waste time chasing the wrong ones. Learn how to identify which tenders or grants are actually worth your time—and how to stop gambling and start strategising.

Why Flying Solo Is Costing You More Than Sleep—and How SBAAS Full Service Coaching Helps

Why Flying Solo Is Costing You More Than Sleep—and How SBAAS Full Service Coaching Helps When “Doing It All” Starts to Feel Like Doing Too Much Running a small business in Australia is a bit like trying to keep a dozen spinning plates in the air—while riding a unicycle, blindfolded, during a mild earthquake. In […]

“I Thought I Did Everything Right”: A Small Business Owner’s Wake-Up Call About Fair Dismissal

“I Thought I Did Everything Right”: A Small Business Owner’s Wake-Up Call About Fair Dismissal Navigating Employee Disputes in the Fitness Industry with SBAAS by Your Side Running a small business isn’t just about balance sheets and marketing plans—it’s deeply personal. It’s about showing up every day for your team, clients, and community. And when […]

Fair Work Crackdown: Over $800,000 in Penalties Sends Clear Message to Small Business Employers

Fair Work Crackdown: Over $800,000 in Penalties Sends Clear Message to Small Business Employers Fair Work Cases: A Wake-Up Call for Small Business Owners in 2025 Australian small business owners are under increased scrutiny as recent Fair Work cases have exposed severe breaches of employment law, particularly relating to vulnerable and migrant workers. In […]

Cutting the Red Tape Trap: The Preliminary Results are in

Cutting the Red Tape Trap: The Preliminary Results are in Preliminary results are in, but first – thanks BNI Australia April was huge. On the first Monday of the month, SBAAS published Reducing Red Tape for Australian Small Businesses: Economic Impact and Reform Opportunities. By Wednesday, BNI Australia, after confirming the project’s political neutrality, pushed […]

The IT Blindspot That’s Putting Your Business at Risk – And How to Fix It Before It’s Too Late

Your “I Don’t Do IT” Attitude is a Ticking Time Bomb – And It’s About to Explode You’re a busy small business owner. You’re focused on growth, on innovation, on building a successful business. I get it – on some weeks I am lucky to get a lunch break, let alone considering the smaller stuff. […]

Cutting the Red Tape Trap: How Smarter Regulation Will Supercharge Australian Small Businesses

Cutting the Red Tape Trap: How Smarter Regulation Will Supercharge Australian Small Businesses Small businesses are the heartbeat of Australia’s economy. Yet, despite their enormous contribution, they are shackled by layers of outdated, excessive, and often confusing regulations. Reducing red tape for small businesses is no longer a nice-to-have — it is essential for driving […]