Preliminary results are in, but first – thanks BNI Australia

April was huge. On the first Monday of the month, SBAAS published Reducing Red Tape for Australian Small Businesses: Economic Impact and Reform Opportunities.

By Wednesday, BNI Australia, after confirming the project’s political neutrality, pushed the whitepaper and an open survey link across more than 6,000 members.

April in Review – Evidence at Speed

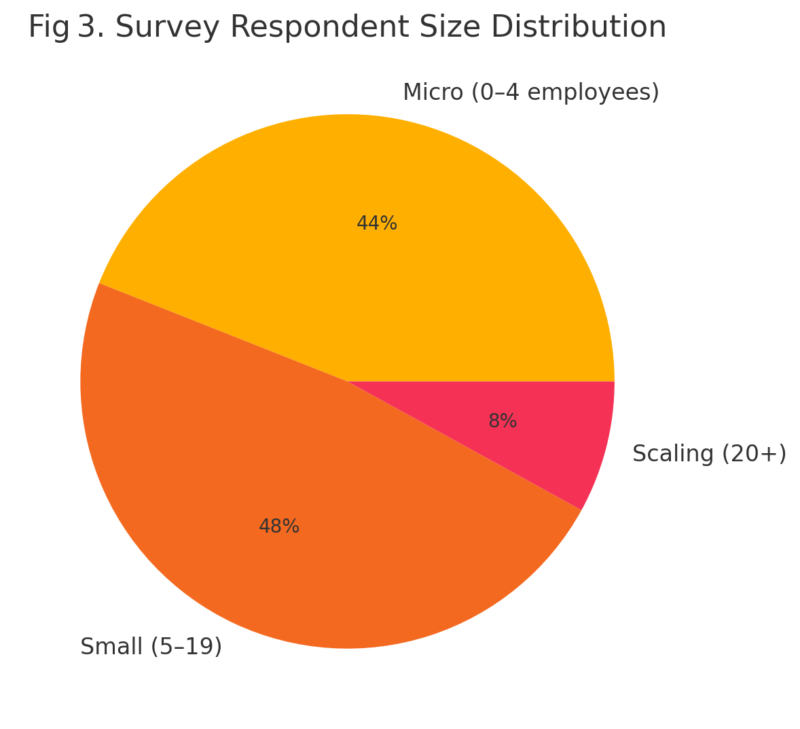

We collected 256 complete responses from every state and territory in three weeks. Those responses and hundreds of partial submissions still under review form the backbone of this interim analysis.

Both stay live.

The whitepaper provides context; the survey captures lived reality. This article synthesises the preliminary numbers, highlights personal stories, and plots the path from data to reform. Reducing red tape for small businesses appears here more than twenty times because repetition mirrors urgency.

Method – Community-Powered, Politically Neutral

We asked three groups of questions:

- Demographics – industry, location, structure, headcount.

- Experience – cost, time, growth decisions, emotional toll.

- Reform priorities – ranked options plus free-text suggestions.

Eligibility was simple: any owner, founder, or director of a firm with fewer than twenty employees, or any pre-launch entrepreneur. Responses were anonymous; email capture was optional. Those who volunteered for follow-up gave explicit consent. We coded raw text twice to strip profanity and reduce bias. The sample delivers a 95 per cent confidence level and a ±6 per cent margin of error for Australia’s 2.5 million small enterprises.

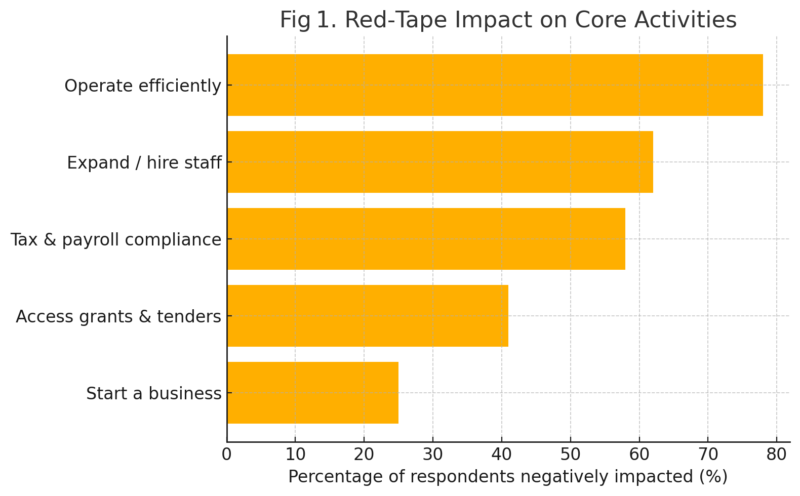

Headline Numbers – Where Regulation Bites

Reducing red tape for small businesses is not abstract ideology. It is daily arithmetic:

- 78 per cent say excessive regulation blocks basic efficiency.

- 62 per cent have frozen hiring or capped headcount.

- 58 per cent outsource payroll or BAS solely because rules are opaque.

- 41 per cent miss grants or tenders after drowning in eligibility checks.

- 31 per cent purposely remain under payroll-tax thresholds.

- 25 per cent aborted or postponed start-ups due to wait times.

- Median owner time lost: 7.5 hours a week.

- Median annual spend on external compliance advice: AU$11 800.

Each number confirms a single truth: reducing red tape for small businesses is the low-hanging fruit of economic reform.

Growth on Ice – How Owners Self-Limit

Payroll-tax thresholds, duplicate state licences, and overlapping safety codes encourage stagnation. Consider these owner voices:

“We hit 18 staff and stopped. Payroll tax at 19 wipes all profit on new contracts.”

“Turnover is capped at $2 million. Cross that line and three new registers kick in. Why bother?”

“Hiring a trainee would trigger a new safety audit. Too much paperwork.”

Beyond payroll, industrial relations rules deter expansion:

“A fifth employee moves us from simple to complex award boundaries. Not worth the risk.”

Reducing red tape for small businesses would remove structural disincentives and channel dormant ambition into growth.

Start-Ups Stuck at the Gate

Australia lauds innovation, yet administrative mazes delay or derail new ventures:

- Eleven-month licence waits for craft distillers.

- Fourteen-month AFSL variations for fintech start-ups.

- Multiple identity checks across unconnected portals.

- Contradictory guidance from hotline staff versus online manuals.

A Brisbane founder captures the frustration:

“Twelve months for a licence variation is a death sentence. Investors walk. Team morale collapses.”

Reducing red tape for small businesses, especially at the pre-revenue stage, safeguards Australia’s future export pipeline and domestic job creation.

The Emotional Balance Sheet

Statistics miss the human cost. Owners speak of exhaustion:

“A day a week lost to forms is a day I don’t sell, innovate, or sleep.”

“WorkCover compliance is so draconian I shelved a second salon.”

“Lockdowns destroyed demand, then fees still landed. I almost quit.”

Several comments veered into blunt anger, emphasising how raw emotion sits beneath polite spreadsheets. SBAAS preserves these voices because policy thrives on reality, not just ratios.

Pain-Point Hierarchy – Target Areas

We asked owners to identify the single biggest obstacle. Results cluster in five zones:

Pain-Point | Frequency | Common Fallout |

Duplicate data entry | High | Time sink |

Payroll-tax thresholds | High | Hiring freeze |

Confusing WHS codes | Medium | Consultant cost |

State–federal overlap | Medium | Approval lag |

Licence wait times | Medium | Start-up abandonment |

Removing even one layer in each zone would unlock immediate capacity.

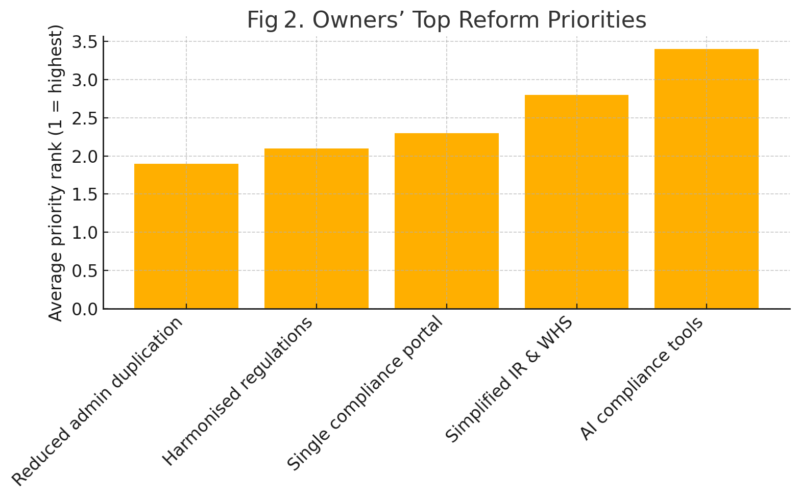

Preferred Fixes – Owners Know What Works

Reducing red tape for small businesses rests on five owner-ranked reforms:

- Slash duplicated administration across tax, payroll, and licensing.

- Harmonise state and territory regulations so cross-border firms navigate one rule-book.

- Create a single national compliance portal linked to ABN and MyGovID.

- Simplify industrial relations and WHS codes for enterprises under twenty staff.

- Promote AI-enabled reporting tools that pre-populate BAS and payroll data.

Notably absent: calls for blanket deregulation. Owners value safety and fairness. They want proportionate, predictable, and efficient oversight.

Economic Upside – Numbers Too Big to Ignore

If compliance hours are halved across the sector:

- 26 million staff-hours would return to productive tasks each year.

- 13,000 full-time roles could materialise at the current average hours.

- AU$ 4.8 billion could be added to gross value-added.

- Commonwealth revenue could climb AU$ 450 million on higher wages and profits.

Reducing red tape for small businesses is fiscal prudence, not fiscal risk.

International Context – Australia Falling Behind

For a decade, Singapore, Canada, and New Zealand have pursued one-in-one-out rules, digital licences, and single-window portals. Australia ranks mid-table on global ease-of-doing-business scores. Without reform, we risk sliding as others accelerate. Reducing red tape for small businesses is Australia’s catch-up strategy.

SBAAS Roadmap – From Data to Action

With April’s evidence banked, SBAAS will:

- Engage every parliamentary party at federal and state levels, including cross-benchers, with complete findings and anonymised case studies.

- Request written commitments on each reform priority and publish responses in a comparative grid.

- Host regulator round-tables to test low-cost solutions, like data-sharing and plain-language templates.

- Expand outreach to industry bodies and local councils for joint reform pilots.

- Keep the survey open through 31 May; promote it via BNI Australia, chambers, and social media.

- Launch the Red Tape Scorecard – biannual public metrics on compliance hours, approval times, and form counts.

Reducing red tape for small businesses remains our single agenda item, free of party logos.

Five Questions Every Voter Should Ask

Take this article, the whitepaper, and the survey links to every candidate.

Ask:

- Which of the five reforms will you enact first, and within what timeframe?

- How will you measure and publish a reduction in paperwork within twelve months?

- Will you back net-zero growth in regulation, one-in, one-out or stronger?

- How will you harmonise federal, state, and local rules?

- When will you host an open forum with local small-business owners to track progress?

Reducing red tape for small businesses should be a threshold question for public office.

Community Call-Out – Your Evidence Matters

We invite:

- Chambers of commerce to circulate these preliminary results.

- Industry federations to submit sector-specific blockers.

- Councils to audit permit chains and publish process maps.

- Owners to document delays and email case files to contact@sbaas.com.au.

Every data point sharpens the reform case.

April Was Only the Beginning

April’s sprint proved three points.

- Founders are eager to share datapoints when a project is apolitical and respectful.

- BNI Australia’s passion for small enterprises can quickly move information.

- Preliminary results already expose policy gaps that are too large to ignore.

Yet April was the opening chapter, not the conclusion. The whitepaper is live. The survey remains open. SBAAS will refine numbers, widen outreach, and keep publishing until paperwork no longer trumps productivity.

Next Contact – For Those Ready to Talk

Many respondents ticked “happy to discuss further”. We thank you. An SBAAS team member will reach out over the coming months to schedule confidential interviews. Your stories will deepen the evidence base and help shape practical pilots with regulators.

Call to Arms – What You Can Do Today

- Read the whitepaper

- Complete the survey (five minutes)

- Share this article with business peers and local candidates.

- Book a consultation with SBAAS if red tape is blocking your next hire or investment.

- Learn about our mission at the SBAAS About Us page.

Reducing red tape for small businesses is the most inclusive growth lever. Every founder unlocked, every apprentice hired, and every export permit issued on time enriches the nation. Let’s move from evidence to action—together.

Sources

- SBAAS (2025). Reducing Red Tape for Australian Small Businesses: Economic Impact and Reform Opportunities

- SBAAS (2025). Small-Business Red-Tape Impact Survey – Business Demographics – internal dataset

- SBAAS (2025). Small-Business Red-Tape Impact Survey – Experiences and Quotes – internal dataset

- SBAAS (2025). Small-Business Red-Tape Impact Survey – Reform Priorities – internal dataset

Eric Allgood

Eric Allgood is the Managing Director of SBAAS and brings over two decades of experience in corporate guidance, with a focus on governance and risk, crisis management, industrial relations, and sustainability.

He founded SBAAS in 2019 to extend his corporate strategies to small businesses, quickly becoming a vital support. His background in IR, governance and risk management, combined with his crisis management skills, has enabled businesses to navigate challenges effectively.

Eric’s commitment to sustainability shapes his approach to fostering inclusive and ethical practices within organisations. His strategic acumen and dedication to sustainable growth have positioned SBAAS as a leader in supporting small businesses through integrity and resilience.

Qualifications:

- Master of Business Law

- MBA (USA)

- Graduate Certificate of Business Administration

- Graduate Certificate of Training and Development

- Diploma of Psychology (University of Warwickshire)

- Bachelor of Applied Management

Memberships:

- Small Business Association of Australia –

International Think Tank Member and Sponsor - Australian Institute of Company Directors – MAICD

- Institute of Community Directors Australia – ICDA

- Australian Human Resource Institute – CAHRI

-

Business in the Wonderful World of Oz – Workplace Health and Safety – A Comprehensive Guide

$29.95 Add to cart -

Business in the Wonderful World of Oz – Risk Management – A Comprehensive Guide

$29.95 Add to cart -

Business in the Wonderful World of Oz – Property Leasing – A Comprehensive Guide

$29.95 Add to cart -

Business in the Wonderful World of Oz – Intellectual Property Rights – A Comprehensive Guide

$29.95 Add to cart -

Business in the Wonderful World of Oz – Future-Ready: Navigating Change and Seizing Opportunity in Australian Business

$29.95 Add to cart -

Business in the Wonderful World of Oz – Fair Work – A Comprehensive Guide

$29.95 Add to cart -

Business in the Wonderful World of Oz – Export and Global Trade – A Comprehensive Guide

$29.95 Add to cart -

Business in the Wonderful World of Oz – Cyber Security – A Comprehensive Guide

$29.95 Add to cart -

Business in the Wonderful Land of Oz – Australian Consumer Law – A Comprehensive Guide

$29.95 Add to cart -

Business in the Wonderful World of Oz – Crisis Management

$29.95 Add to cart -

Business in the Wonderful World of Oz – The Ultimate Guide

$29.95 Add to cart