Is Business Coaching Really Worth It? Here’s What Every Aussie SME Needs to Know

Is Business Coaching Really Worth It? Here’s What Every Aussie SME Needs to Know The Real ROI of Business Coaching for SMEs In Australia’s competitive economy, small business owners are under increasing pressure to grow, adapt and succeed. But with tight budgets and limited time, many ask, “Is business coaching really worth it?” This article […]

Unlock Real Growth: Why Systemising Your Business Isn’t Optional

Unlock Real Growth: Why Systemising Your Business Isn’t Optional How to Systemise Your Business for Sustainable Growth Running a small business in Australia is rewarding, but it’s challenging. Many owners juggle roles, rely on memory for processes and constantly put out fires. Over time, this causes stress, slows operations, and caps growth potential. But there’s […]

ServiceM8: The Aussie Tradie’s Secret Weapon to Simplify, Streamline and Scale

ServiceM8: The Aussie Tradie’s Secret Weapon to Simplify, Streamline and Scale What Is ServiceM8 and How Can It Streamline Your Operations? Running a small business isn’t easy. Between chasing quotes, managing staff, keeping customers happy and trying to stay on top of paperwork, most owners feel like they’re being pulled in ten directions at once. […]

Unleashing the Power of Generative AI – Essential Strategies for Australian Small Businesses

Unleashing the Power of Generative AI – Essential Strategies for Australian Small Businesses The AI Revolution and Australian Small Businesses Generative AI is dramatically reshaping the business landscape. Australian small businesses, often agile yet resource-constrained, stand to benefit enormously from integrating generative AI into their operations. Embracing this powerful technology enables innovation, efficiency, and sustained […]

Stuck in Neutral: Why Australian Small Businesses Stall and How to Restart Growth

Stuck in Neutral: Why Australian Small Businesses Stall and How to Restart Growth Why SMEs Get Stuck, and How to Break Through Running a small business in Australia isn’t easy. High overheads, economic uncertainty, and shifting consumer behaviours can cause even the most promising ventures to stall. Business stagnation is more than just a temporary […]

Thriving Amid Global Tariffs: Essential Strategies for Australian Businesses

Thriving Amid Global Tariffs: Essential Strategies for Australian Businesses Tariffs and Trade – Challenges and Opportunities for Australia Australian businesses face growing pressures from international tariffs and shifting trade corridors. Understanding these changes and developing proactive strategies is essential for maintaining competitiveness in the global economy. Understanding Global Tariffs and Trade Dynamics Tariffs are reshaping […]

Stop Guessing: Is Your Business Really Healthy? Here’s How to Know for Sure

Stop Guessing: Is Your Business Really Healthy? Here’s How to Know for Sure The Ultimate Business Health Checklist for SMEs Why Your Business Needs a Health Check Every small business owner wants to know the answer to one question: How do I check if my business is doing well? This question is more important than […]

Capturing Consumer Attention – Strategic Insights for Australian Small Businesses

Capturing Consumer Attention – Strategic Insights for Australian Small Businesses The Battle for Consumer Attention Australian small businesses operate in a crowded marketplace where consumer attention is increasingly fragmented. Consumers face endless choices and distractions, making their attention a precious commodity. Understanding how to effectively capture and retain this attention is crucial for thriving businesses. […]

One Wrong Step: Why Skipping Appropriate Policies and Procedures Can Sink Your Small Business

One Wrong Step: Why Skipping Appropriate Policies and Procedures Can Sink Your Small Business The Invisible Trip-Wire Running a business often feels like sprinting while laying track simultaneously. Amid the daily scramble, documentation can slip to the bottom of the to-do list. Appropriate policies and procedures are not mere paperwork but a legal, financial, and […]

Forget Motivation – Why Accountability Is the Real Powerhouse in Business Growth

Motivation feels good, but it fades. Accountability delivers the real, lasting impact businesses need. Discover why accountability is more powerful than motivation in business, and how to make it work for you.

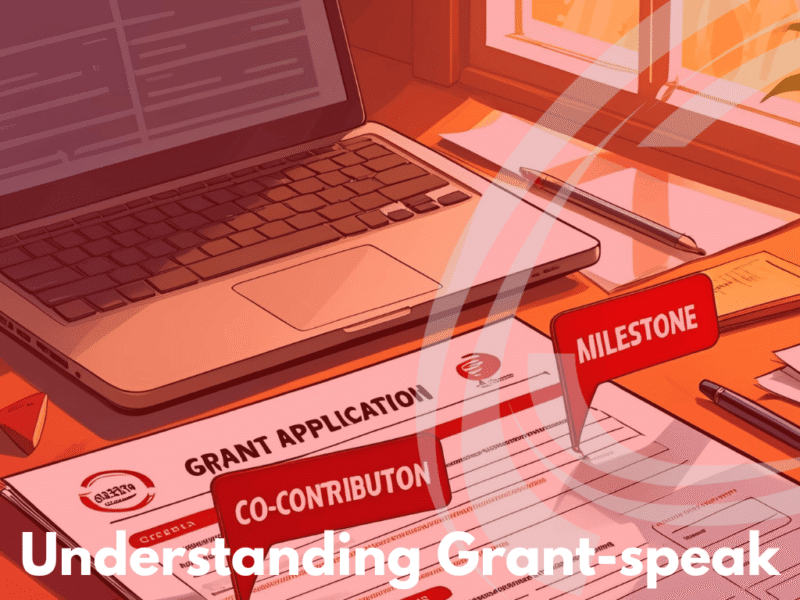

Decode Before You Commit: Navigating Grant Jargon, What to Look for Before You Apply

Decode Before You Commit: Navigating Grant Jargon, What to Look for Before You Apply Grants are often marketed as “free money”, a tempting proposition for any small business in search of funding. But behind every grant application is a dense set of guidelines, eligibility criteria, funding terms, and compliance expectations. Too many business owners skim […]

The Vanity Trap: What Small Businesses Get Wrong About Social Media Metrics

The Vanity Trap: What Small Businesses Get Wrong About Social Media Metrics Your post got 5,000 views. You celebrated. Your competitor got 15 likes and booked three new clients. You wondered what went wrong. Here’s the truth: numbers can lie, or at least mislead. In the noisy, fast-paced world of social media, metrics are everywhere. […]